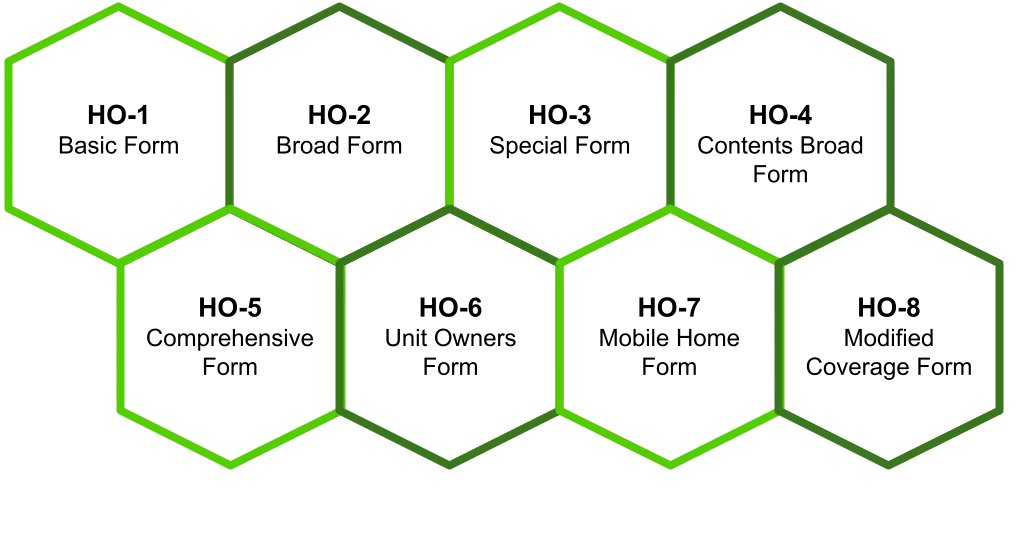

Types of Homeowners Insurance

There are eight different home insurance policy types suited to fit different needs. These are HO-1 through HO-8.

We'll Help You Find the Policy That Fits.

This is the most basic home insurance coverage. It covers only the property and its structures, but not your personal belongings or liability. HO-1 coverage will pay for damages caused by specific, named events called perils. These will typically include fire and lightning, damage from aircraft or vehicles, smoke, theft, vandalism, hail and windstorms, explosions, riots, and volcanic eruptions.

HO-2 insurance builds on HO-1 by adding coverage for your personal belongings along with the structures and property. Some HO-2 policies will also cover personal liability. With an HO-2 policy, you get coverage for the named perils covered under HO-1 with additional coverage in the event of damage due to: a falling object; weight from ice, snow or sleet; accidental discharge or overflow from water or steam in the home; freezing of pipes and heating and air conditioner systems; tearing apart, burning or cracking from some household systems; and sudden and accidental damage from certain electrical currents.

This is the typical homeowner’s policy. HO-3 Special Form policies cover the property and structures, personal belongings, liability, additional living expenses (lodging while the home is repaired), and medical payments. Personal property is covered for named perils, but the home is insured with open perils coverage, meaning every event is covered minus the named exceptions listed in your policy.

HO-4 is renter’s insurance. It provides coverage for personal property, but not for the structure itself, since this is covered by the landlord’s policy. Your personal property is covered for named perils, which are similar to the events covered under HO-3 for personal property.

HO-5 is the comprehensive home insurance option, which is recommended for people with many valuable possessions. This policy covers the home, personal property, liability, additional living expenses, and medical payments for others. This is an open perils policy with a small list of named exceptions, which include: earth movement; government actions or laws; infestation of birds, rodents or insects; intentional loss; mechanical breakdown; mold; nuclear hazard; pets; vandalism if the property is vacant more than two months; war; and water damage from floods or sewer backup.

HO-6 is coverage for condo owners. It covers everything inside the unit, and sometimes interior walls. This is a named perils policy with similar coverage to renter’s insurance.

HO-7 is a policy for people who own mobile and manufactured homes, including RVs and trailers. This covers the structure, personal possessions, liability, additional living expenses, and medical payments. The exterior is covered for open perils, and personal property is covered for named perils similar to those for HO-1.

People with old or difficult to replace homes that would cost more to repair than the value of the home will want an HO-8 policy. This covers the property, personal belongings, liability, additional living expenses, and medical payments. The structure and personal property are covered for named perils similar to HO-1.

Which Homeowners Policy Do You Need?

Without the help of an expert, it can be difficult to decide which type of homeowners insurance coverage makes the most sense for your home. The agents at Hometown Financial Group are here to help. Give us a call today to schedule an appointment.

Request an appointment.

By submitting your information, you give Hometown Financial Group permission to contact you.